Overview of Small Business Loans

Business small loans – Small business loans are vital financial tools that enable entrepreneurs to secure the funding they need to start or grow their businesses. These loans serve various purposes, including purchasing equipment, managing cash flow, and expanding operations. Understanding the different types of small business loans available is essential for entrepreneurs looking to make informed financial decisions.

Types of Small Business Loans

There are several types of small business loans that cater to different needs. Here are some of the most common options:

- Term Loans: These loans provide a lump sum that is repaid over a fixed period with interest. They’re commonly used for major purchases or investments.

- Lines of Credit: A flexible borrowing option that allows businesses to draw funds as needed, up to a pre-approved limit.

- Equipment Financing: Specifically designed for purchasing equipment, this type of loan uses the equipment itself as collateral.

- Invoice Financing: This allows businesses to borrow against outstanding invoices, improving cash flow while waiting for customer payments.

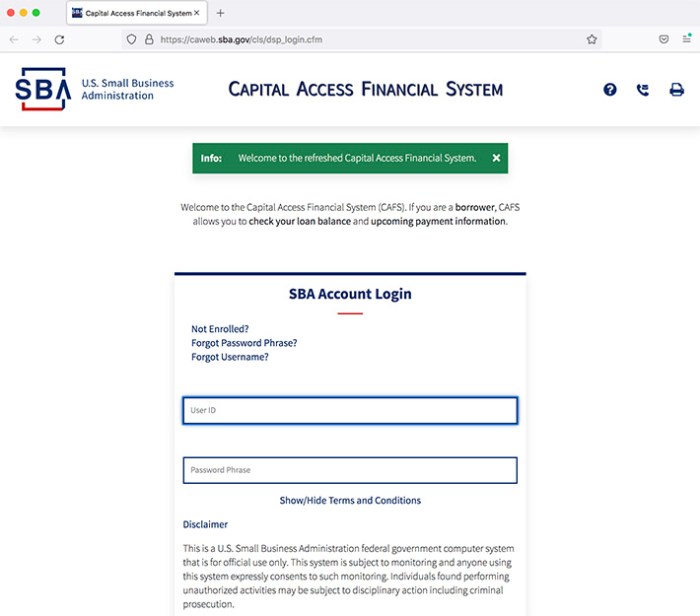

- SBA Loans: Backed by the Small Business Administration, these loans offer favorable terms and lower interest rates, making them a popular choice for small businesses.

Key features of small business loans include flexible repayment terms, competitive interest rates, and the potential for building business credit. The benefits for entrepreneurs often translate into better cash flow management and the ability to seize growth opportunities.

Eligibility Criteria

Understanding the eligibility criteria for obtaining small business loans is crucial for entrepreneurs. Common requirements often include a solid business plan, a minimum credit score, and a demonstration of cash flow.

Documents Required for Loan Applications

When applying for a small business loan, businesses typically need to provide several documents, including:

- Personal and business credit reports

- Financial statements (income statement and balance sheet)

- Tax returns for the business and owners

- Business licenses and registrations

- A detailed business plan outlining the use of funds

Lenders evaluate these documents to assess the risk and viability of the business, ensuring that they make informed lending decisions.

Application Process

The application process for a small business loan can seem daunting, but understanding each step can streamline the experience.

Step-by-Step Application Process

Applying for a small business loan generally follows these steps:

- Research Loan Options: Identify which type of loan best fits your business needs.

- Gather Required Documents: Compile all necessary documentation to support your application.

- Complete the Application: Fill out the lender’s application form accurately.

- Submit the Application: Send the application along with all supporting documents.

- Loan Review: The lender will review your application and may request additional information.

- Approval and Funding: If approved, review the terms and conditions before accepting the loan.

The Role of Credit Scores

Credit scores play a significant role in the loan application process. Lenders use credit scores to evaluate the borrower’s creditworthiness, which can directly impact the interest rates and terms offered. A higher credit score typically results in more favorable loan conditions, while a lower score may restrict options and increase costs.

Types of Lenders: Business Small Loans

Choosing the right lender is essential for securing a small business loan that fits your needs.

Comparative Analysis of Lenders

Here’s a comparison of traditional banks, credit unions, and online lenders:

| Type of Lender | Advantages | Disadvantages |

|---|---|---|

| Traditional Banks | Lower interest rates, established trust | Lengthy application process, strict eligibility criteria |

| Credit Unions | Member-focused, personalized service | Limited loan amounts, regional restrictions |

| Online Lenders | Fast application and funding, less strict requirements | Higher interest rates, potential for hidden fees |

Additionally, alternative funding sources such as crowdfunding, peer-to-peer lending, and venture capital can provide unique avenues for financing.

Interest Rates and Terms

Understanding how interest rates are determined is crucial for borrowers.

Determining Interest Rates

Interest rates for small business loans are influenced by several factors, including:

- The borrower’s creditworthiness

- The economic environment and market conditions

- The type of loan and repayment terms

Typical terms and conditions associated with small business loans include repayment periods ranging from one to ten years, with interest rates varying widely based on the lender and type of loan.

Repayment Strategies

Developing effective repayment strategies is vital for maintaining financial health.

Managing Loan Repayments

To effectively manage loan repayments and maintain cash flow, consider the following strategies:

- Create a detailed budget that includes loan repayments as a fixed expense.

- Explore options for refinancing or consolidating loans if necessary.

- Communicate proactively with lenders if cash flow issues arise.

The consequences of defaulting on a small business loan can be severe, including damage to credit ratings and potential legal actions. Thus, understanding repayment terms and negotiating whenever possible can help avoid financial pitfalls.

Impact on Business Growth

Small business loans can play a crucial role in facilitating growth and expansion.

Facilitating Growth, Business small loans

Loans can provide the necessary capital to invest in new projects, hire additional staff, or expand operations. For instance, many startups have leveraged loans to scale their business, resulting in significant market presence and revenue growth.

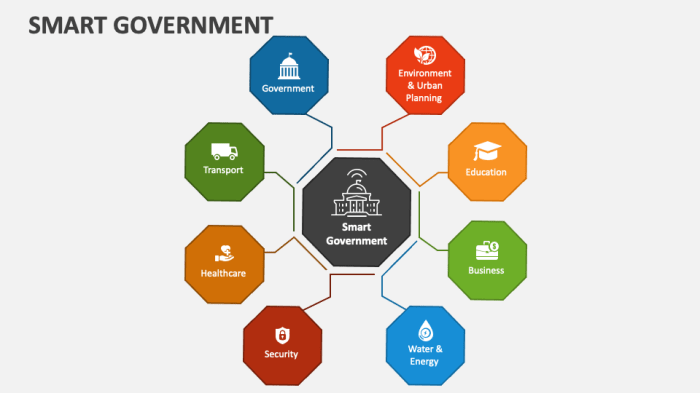

Resources for Business Owners

Various resources are available to assist business owners in navigating the complexities of small business loans.

Online Resources and Support

Business owners can access a wealth of information and support through:

- Government websites offering guidelines on SBA loans.

- Financial blogs and forums that provide insights and experiences from other entrepreneurs.

- Local Small Business Development Centers (SBDCs) that offer free consulting services.

Financial advisors and consultants can also provide valuable assistance in preparing loan applications and understanding financial options. Additionally, organizations at both local and national levels often have programs and resources to support small business financing initiatives.