Overview of SBA Small Business Loans

SBA small business loans play a crucial role in the entrepreneurial landscape, providing vital financial support to small businesses across the United States. These loans are designed to help entrepreneurs kickstart their ventures, sustain operations, or expand their existing business, making them an essential tool for fostering economic growth and innovation.The types of SBA loans available vary to cater to the diverse needs of small businesses.

The most common types include the 7(a) loan program, which is suitable for a wide range of business purposes, including working capital and equipment purchase; the CDC/504 loan program, which focuses on real estate and large equipment purchases; and the Microloan program, which offers smaller loans for startups and small enterprises. Understanding these options helps businesses select the best fit for their financial needs.Eligibility criteria for small businesses applying for SBA loans typically include being a for-profit business, operating within the United States, and meeting size standards as defined by the SBA.

Additional requirements often involve demonstrating a need for the loan, having reasonable creditworthiness, and showing a plan for repayment. Meeting these criteria is essential for increasing the chances of loan approval.

Application Process for SBA Small Business Loans

The application process for obtaining an SBA loan is structured yet straightforward, designed to ensure thorough evaluation. First, businesses must gather necessary documentation, including a business plan, financial statements, tax returns, and personal financial information. Following this, the business owner typically completes the loan application, detailing the requested amount and purpose.Documentation required for the application includes:

- Business plan outlining the business model and market analysis.

- Financial statements for the past three years, including balance sheets and income statements.

- Personal tax returns for the past two years.

- Business tax returns for the past three years.

- Cash flow projections and a detailed use of funds statement.

During the application process, several common pitfalls can hinder approval. Avoiding these pitfalls is crucial for a successful application:

- Inadequate documentation or incomplete application forms.

- Insufficient financial projections or unrealistic expectations.

- Poor credit history or failure to address credit issues proactively.

- Not aligning the loan purpose with the SBA guidelines.

Benefits of SBA Small Business Loans

Securing an SBA loan comes with significant advantages compared to traditional financing options. One of the primary benefits is lower interest rates, which are typically more favorable than those offered by conventional lenders. Additionally, SBA loans often come with longer repayment terms, allowing businesses to manage their cash flow more effectively.When comparing interest rates and repayment terms, SBA loans generally offer:

| Loan Type | Average Interest Rate | Repayment Terms |

|---|---|---|

| 7(a) Loan | 6% – 10% | Up to 25 years |

| CDC/504 Loan | 3% – 6% | 10 or 20 years |

| Microloan | 8% – 13% | 6 years |

Furthermore, SBA loans provide enhanced flexibility in how loans can be used, making them suitable for various purposes, from purchasing inventory to refinancing existing debt. They also offer a level of assurance in that they are backed by the government, which can encourage lenders to approve applications that might otherwise be rejected.

Challenges in Securing SBA Small Business Loans

Despite their advantages, small businesses often face challenges when applying for SBA small business loans. A significant hurdle is the thoroughness of the documentation process; many applicants underestimate the level of detail required or the chances of delays due to incomplete information.Credit scores play a critical role in the likelihood of securing an SBA loan. Generally, a higher credit score increases a business’s chances of approval, while lower scores can limit access to funding options.

Applicants should be aware of their credit history and take steps to improve their scores before applying.To overcome obstacles in the application process, small businesses can adopt several strategies:

- Engage with a financial advisor or loan consultant for guidance.

- Ensure all documentation is complete and accurately reflects the business’s financial health.

- Prepare a comprehensive business plan that Artikels future growth and repayment strategies.

- Consider alternative financing options if SBA loans are not feasible.

Success Stories of SBA Small Business Loan Recipients

Many businesses have successfully obtained SBA loans and used them to achieve substantial growth. For instance, a local bakery secured an SBA loan to expand its operations, allowing it to double its production capacity and increase revenue significantly. Another tech startup used an SBA loan to develop cutting-edge software, leading to rapid market expansion and a strong customer base.The impact of SBA loans on these businesses often manifests in improved operations and increased market presence.

Key takeaways from these success stories include:

- The importance of a well-prepared business plan.

- Utilizing SBA loans not just for immediate needs but as a strategic growth tool.

- The potential for long-term relationships with lenders that can provide future financing opportunities.

Future of SBA Small Business Loans

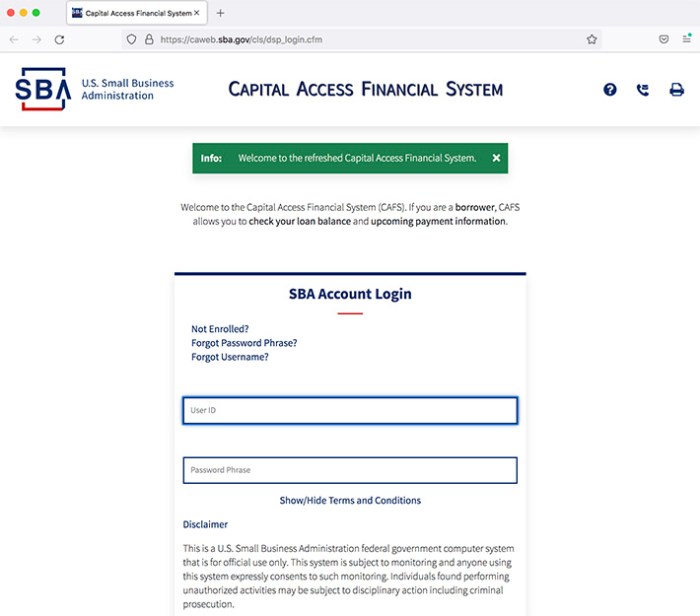

Emerging trends related to SBA loans indicate a growing focus on technology and digital platforms to streamline the application process. As more lenders adopt online processing, it becomes easier for small businesses to access these funding opportunities.Potential changes in legislation affecting SBA lending practices could further enhance accessibility. For example, discussions surrounding increasing loan limits and expanding eligibility criteria may open doors for a broader range of small businesses.

To illustrate the future prospects of various SBA loan programs, here’s a comparative overview:

| SBA Loan Program | Future Trends | Potential Benefits |

|---|---|---|

| 7(a) Loan | Increased loan limits | Wider access to capital |

| CDC/504 Loan | Focus on green technology | Support for sustainable growth |

| Microloan | Enhanced digital platforms | Faster, more efficient applications |